MARKET OUTLOOK

- With over 6.3 msf of bulk under construction, expect vacancy rates to trend slightly higher in the coming quarters.

- Given strong leasing activity in Q4 2025, expect 2026 to continue the momentum.

- 2026 absorption should outpace 2025 absorption with fewer second-generation vacancies expected.

- Bulk Inventory is expected to reach the 100 msf mark by mid-year 2027.

MARKET FUNDAMENTALS

YOY

Chg

Outlook

3.7%

Vacancy Rate

3.9M

YTD Net Absorption, SF

$6.55

Asking Rent, PSF

ECONOMIC INDICATORS

YOY

Chg

Outlook

724K*

Louisville Employment

4.3%*

Louisville Unemployment Rate

4.6%*

United States Unemployment Rate

Source BLS

*Due to the government shutdown, latest figures are from September 2025.

KEY INSIGHTS

ECONOMIC OVERVIEW

The U.S. economy demonstrated notable resilience entering the fourth quarter of 2025, even as global uncertainty persisted. With more than 110 active geopolitical conflicts worldwide, international markets faced continued volatility; however, the U.S. remained comparatively stable. Economic indicators reflected this strength, with the Atlanta Fed’s GDPNow model projecting 3.0% real GDP growth as of late December. Inflation continued to cool, remaining within the Federal Reserve’s target range, reinforcing price stability. In response, the Federal Reserve lowered the federal funds rate, supporting economic expansion while maintaining inflation control. Collectively, these factors underscored a national economy that continued to grow steadily despite a complex global backdrop.Louisville’s local economy mirrored this positive momentum in Q4 2025. The metro area maintained a low unemployment rate near 4.0% as of September, reflecting a stable labor market and healthy workforce participation. Economic development activity remained robust, supported by a strong pipeline of active projects representing approximately $3.3 billion in potential investment and more than 4,600 anticipated new jobs initially identified at the end of 2024. Throughout 2025, both business attraction and expansion efforts contributed to a diversified and resilient regional economy. Louisville’s continued emphasis on innovation, industry diversity, and talent development helped sustain investor confidence and position the region for long-term growth.

MARKET OVERVIEW

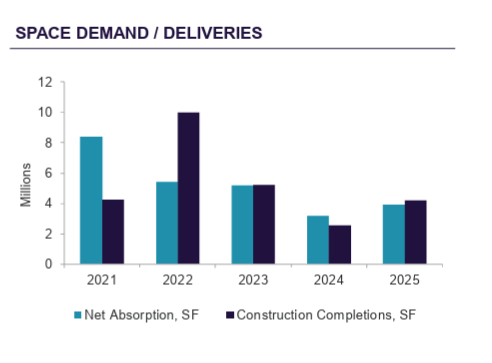

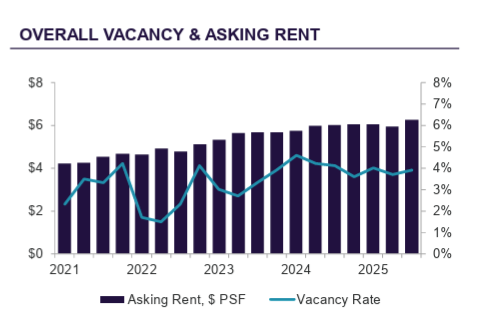

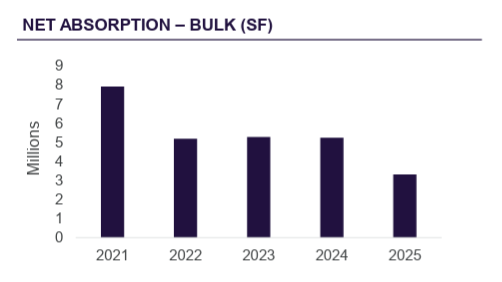

Louisville’s industrial market closed 2025 on a strong note, driven by a particularly active fourth quarter. Year-to-date leasing totals were similar to 2024’s numbers. Q4 alone delivered 3.0 million square feet of new leasing activity, the strongest quarter of the year, led by the South and West/Southwest submarkets. After lagging earlier in the year, net absorption rebounded sharply in Q4 with 2.6 million square feet of occupancy gains. This pushed year-to-date absorption to 3.9 million square feet, exceeding 2024’s 3.3 million square feet. The overall vacancy rate declined 20 basis points year-over-year to 3.7%, matching the level recorded at the end of 2024.

BULK OVERVIEW

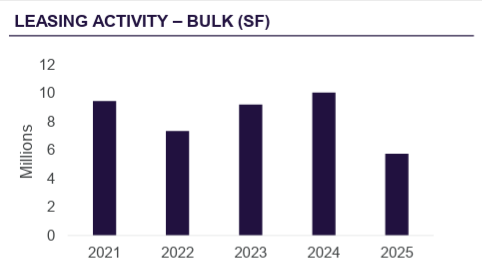

The bulk industrial segment also benefited from a late-year surge in activity. Fourth-quarter bulk leasing reached 2.6 million square feet, surpassing Q4 2024 totals. Positive absorption of 2.5 million square feet in Q4 significantly improved annual performance, bringing 2025 bulk absorption to 3.3 million square feet. The West/Southwest submarket led activity, highlighted by major leases from DQS and Foxconn. Despite 2.7 million square feet of construction deliveries in Q4, bulk vacancy declined 40 basis points from Q3 to 6.0%.

CONSTRUCTION OVERVIEW

Construction activity remained elevated throughout 2025, with 4.0 million square feet of new bulk inventory delivered—nearly double 2024 levels. Speculative development accounted for the majority of completions, and the Southern Indiana submarket led all areas. With 6.3 million square feet currently under construction and 7.6 million square feet planned, developers remain bullish as Louisville’s industrial market enters 2026 with strong fundamentals and continued growth expectations.