MARKET OUTLOOK

- A lower interest rate environment should free up lending activity, contributing to an increase in sales activity across all segments of the commercial real estate sector.

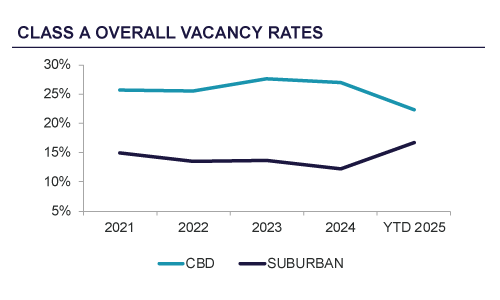

- After reaching record highs, vacancy statistics in the CBD should begin to improve notably as several large office buildings and towers are decommissioned and removed from the city’s leasable office inventory.

- Top of market, Class A office space is beginning to run in short supply in the suburbs. As tenant competition heats up for the few remaining spaces, expect landlords to adjust rents upwards to meet the market.

MARKET FUNDAMENTALS

YOY

Chg

Outlook

19.2%

Vacancy Rate

-553K

YTD Net Absorption, SF

$18.92

Asking Rent, PSF

ECONOMIC INDICATORS

YOY

Chg

Outlook

724.4K

Louisville Employment

4.3%

Louisville Unemployment Rate

4.3%

United States Unemployment Rate

Source BLS

KEY INSIGHTS

Commercial real estate in the U.S. demonstrated resilience through the third quarter of 2025, and improving market conditions suggest a stronger close to the year. At its September meeting, the Federal Reserve cut the federal funds rate by 25 basis points to 4.09%, with two additional cuts anticipated before year’s end. U.S. GDP rose by 3.8% in Q2, defying expectations, while inflation—though above the Fed’s 2.0% target—has moderated.

Louisville’s economy mirrored the national trend, maintaining stable growth into late 2025. The city’s unemployment rate held at 4.3% through Q2, with modest increases expected next quarter attributed to a growing labor force rather than job losses. Economic momentum is being fueled by industrial expansion, manufacturing growth, and private development activity. The Louisville Downtown Development Strategy, now one year into its 10-year plan, reports that nearly half of its 65 proposed projects are in development or planning phases. Infrastructure upgrades on Interstates 65 and 264, along with the reconfiguration of Main, Market, and Jefferson Streets, are expected to enhance mobility and accessibility in the Central Business District (CBD).

Tourism continues to be a major economic driver, bolstered by record-breaking attendance at September’s Bourbon & Beyond and Louder Than Life festivals, which drew more than 450,000 visitors and generated $43 million in local impact. Citywide hotel occupancy exceeded 80%, demonstrating Louisville’s growing national profile as a destination for entertainment and investment.

Central Business District (CBD)

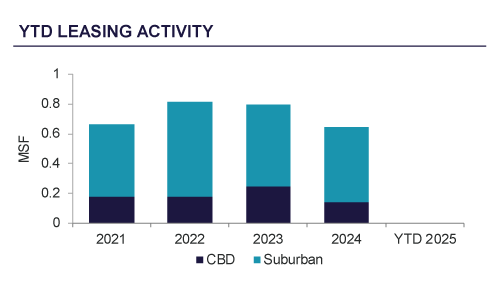

Leasing activity in the CBD surged in Q3 2025, totaling 254,885 square feet (sf)—a sharp increase from 98,190 sf in Q3 2024. with class A properties accounting for the majority After a slow first half of the year, this marked a strong turnaround in downtown leasing momentum.

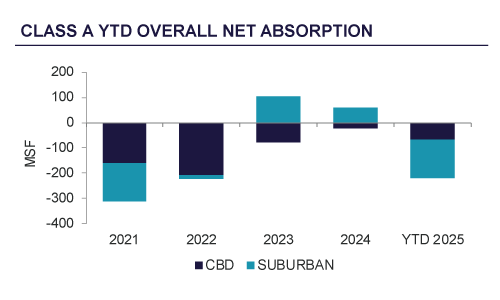

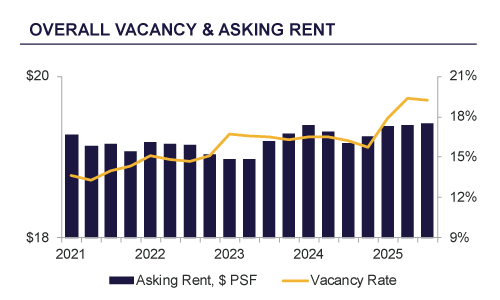

CBD absorption remained slightly negative at negative 2,929 sf, but this represented a major improvement from -64,586 sf in Q2. Class A assets posted positive absorption of 6,178 sf, offsetting losses in Class B space negative 9,107 sf. Vacancy in the CBD held steady at 22.4%, down 10 basis points from Q2. Class A and B vacancies were virtually unchanged, while rental rates edged slightly lower to $17.67 per square foot (psf) overall. Class A averaged $19.53 psf and Class B averaged $15.92 psf.

Suburban

Suburban office activity remained muted with 49,405 sf of new leasing in Q3, down more than 120,000 sf from the same period last year. Class A properties captured 39,036 sf, led by steady demand in the Hurstbourne/Eastpoint submarket. Negative absorption slowed considerably to negative 17,366 sf, a significant improvement from the heavy losses earlier in 2025. The suburban vacancy rate decreased to 16.7%, while Class A rents remained stable at $21.25 psf.

Outlook

As office demand evolves, many owners—particularly in suburban markets—are exploring redevelopment opportunities into multifamily, hospitality, or retail uses. This adaptive trend could redefine Louisville’s office landscape, balancing the city’s commercial footprint with emerging property needs in a changing economic environment.